Compare car insurance quotes now.

In the process, you've probably been offered credit insurance or loan protection products from your lender or had offers flooding your mailbox.

These products are touted as a way to protect your family's finances by canceling or suspending your debt if you die, become disabled or lose your job. But they typically come with hefty costs and in reality aren't the best way to protect your family's future.

What is loan protection insurance?

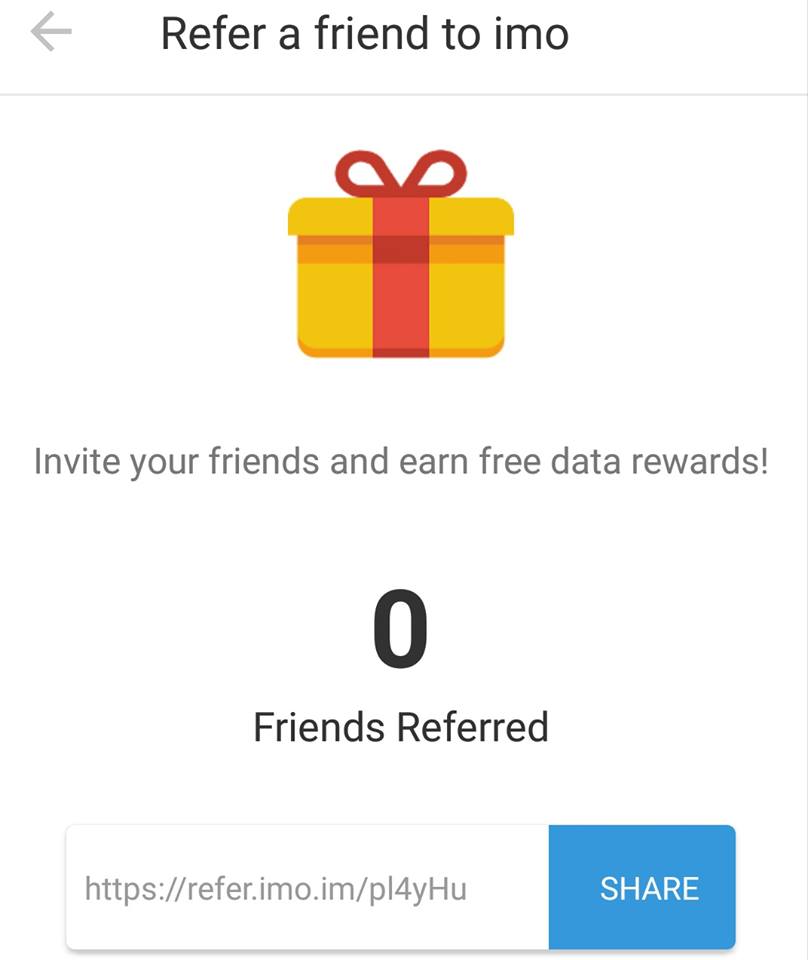

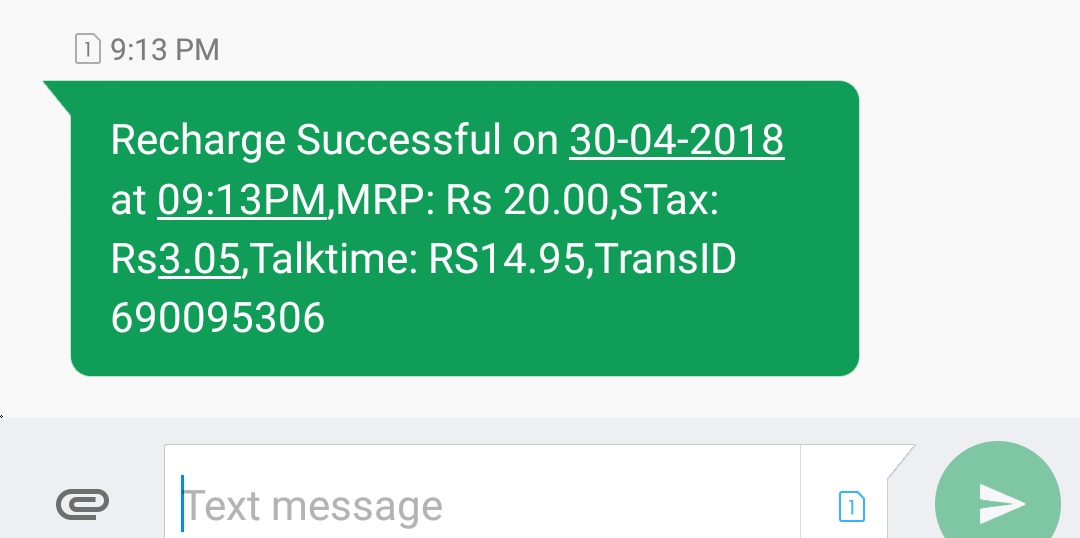

Refer IMO App To Friends & Get Rs 70 Free Recharge For Each Friend

Step to Join IMO App & How To Refer Your Friends To Get Free Recharge:

- First Of all Download Updated Version of IMP App from here: [ Download IMO App ]

- Now Open it and enter your mobile number and Verify it Via OTP.

- As You verified You come to IMO Home screen then Refer pop up skip this popup.

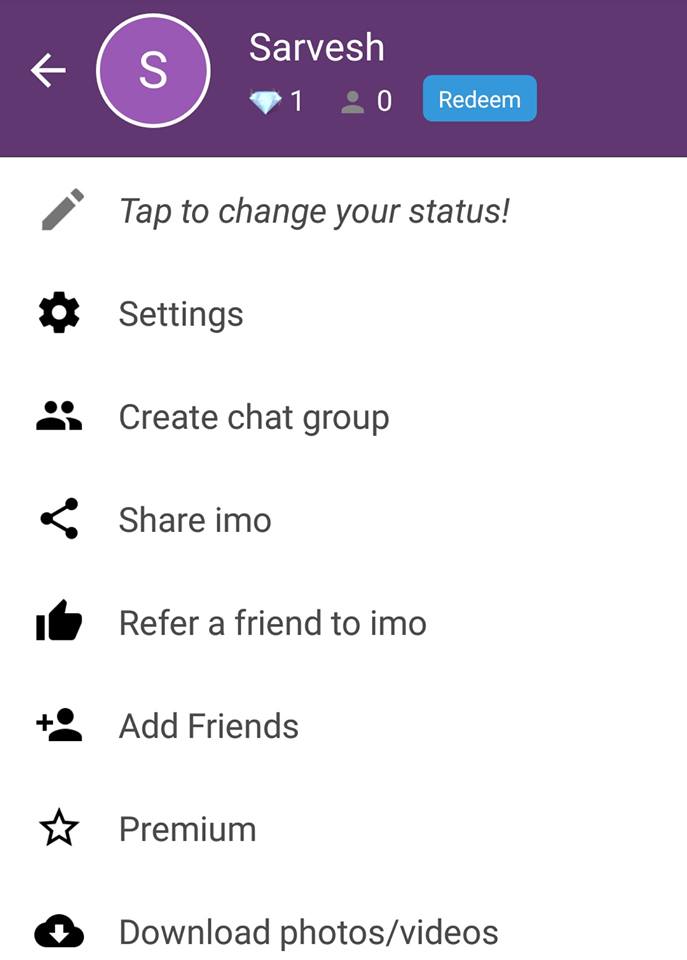

- Now Go to the Profile section left side and Click Refer a friend to IMO section.

It’s insurance to pay your credit balances and loans if you are injured or die. According to the Federal Trade Commission (FTC), there are four main types:

- Credit life insurance pays off all or some of your loan if you die.

- Credit disability insurance makes loan payments if you can't work because you're ill or injured.

- Involuntary unemployment insurance pays on your loan if you lose your job and it's not your fault.

- Credit property insurance offers protection if personal property that is used to secure a loan is destroyed in an accident, theft or natural disaster.

While these are typically lumped together, there are differences. Credit insurance products, such as mortgage protection insurance, are regulated by the state, while debt protection products, such as those for credit cards, fall under the jurisdiction of the Consumer Financial Protection Bureau.

While a lender may recommend or even pressure you to purchase credit protection, the FTC warns it's illegal for a lender to include the insurance without your permission.

What does mortgage protection insurance cover?

When you take out a mortgage, you're likely to receive offers of mortgage protection insurance. The offers may come from your lender or from independent insurance companies.

With mortgage protection insurance, if you die, the insurance is paid directly to the lender to pay off the loan. That differs from traditional life insurance, which makes payment to your beneficiary, and they can allocate the money as they see fit.

Mortgage protection insurance is different from private mortgage insurance (PMI), which you may be required to buy as a condition of your loan if you put less than 20 percent down on a house. PMI doesn’t pay off the mortgage; it pays the lender if you fail to make your payments.

Some mortgage protection insurance benefits gradually decrease over time. Ostensibly that's tied to the declining balance of your mortgage.

You also may see your premiums change over time. So you run the risk of premiums increasing and the payout decreasing.

You also may be offered mortgage disability insurance or mortgage unemployment insurance to cover your payments because of disability or job loss. The money will be paid directly to your lender. With traditional disability insurance, you receive compensation if you're unable to work for a certain period of time.

You may be offered similar types of life, disability and unemployment coverage if you take out an auto loan, open credit cards, or take out a personal loan.

Gap: Extra insurance that's worth the money

One type of extra insurance you might want to consider is gap insurance, which covers the difference between the actual cash value of your vehicle and the current outstanding balance on your loan if your car is totaled.

So if you owe $25,000 on your car and it's only worth $20,000, gap insurance will make up the difference.

You may be offered the insurance by the dealership where you buy your car, by the bank or credit union where you finance your car, or through some auto insurance companies. Be sure to shop around for the best price, as it can vary widely. Insurers typically offer the lowest price.

A cheaper alternative to most loan protection insurance

If you're worried about leaving your loved ones with debts to pay if you die, or if you worry about paying your bills if you're disabled, you usually can find better alternatives than those offered by lenders.

Even the FTC cautions it may be cheaper to purchase life insurance than credit insurance.

A 2011 report by the U.S. Government Accountability Office found that in 2009, consumers paid about $2.4 billion for debt protection for credit cards. Annual costs of these products often exceeded 10 percent of the consumer's average monthly balance, and they received 21 cents in benefits for every $1 spent on protection.

Consider a term life insurance policy instead, which covers you for a certain length of time, such as 20 or 30 years. If you die after 10 years, your beneficiaries would receive the face value of your policy when you die and not pay taxes on it. If you died after 35 years, they'd receive nothing.

Life insurance premiums are typically cheaper if you buy a policy when you're younger.

If you're older or in poor health, you might consider guaranteed or simplified-issue life insurance. Policies are generally offered for small amounts, such as $10,000 or $20,000.

If you worry about making your payments if you're disabled, you can purchase short- and long-term disability insurance.

Questions to ask about loan protection offers

If you're still interested in credit insurance and debt protection products, the FTC has a list of questions you should consider.

- How much is the premium?

- Will the premium be financed as part of the loan? If so, it will increase your loan amount and you'll pay additional interest.

- Can you pay monthly instead of financing the entire premium as part of your loan?

- How much lower would your monthly loan payment be without credit insurance?

- Will the insurance cover the full length of your loan and the full loan amount?

- What are the limits and exclusions on payment of benefits, or what exactly is covered and not covered?

- Is there a waiting period before coverage becomes effective?

- If you have a co-borrower, what coverage does he or she have and at what cost?

- Can you cancel the insurance? If so, what kind of refund is available?

No comments:

Post a Comment